Redfin sends out a monthly newsletter that digests all the real estate news from 20 – 30 sources into one portrait of what’s going on in real estate. All the folks who register on our site have the option to get the newsletter, and of course anyone can unsubscribe.

By popular demand, we’re now publishing the newsletter on our blog; if you want to get it hot off the presses, register for a new Redfin account, or update an existing account to ask for the updates.

And yeah, I know, the newsletter is way too long. And it doesn’t include any marketing messages or calls to action; partly we don’t have the brains to do this, and partly we don’t have the stomach.

Regards, Glenn

Howdy Redfinnians!

Spread the word: Redfin is profitable! And then hold that thought! Because we have to talk about the topsy-turvy, what-da-heck-is-going-on real estate market first…

Prices Are Up for the Month, Sort Of, But Down Over Last Year

Case Shiller, the index that economists use as the most reliable measure of home prices, reports this morning that May home prices increased .45% over April; this is the first increase since July 2006. Once we adjust for seasonality – home prices tend to increase in the summer – the gain becomes a loss nationwide of .2% . But even after this adjustment, the Bay Area (+.7%), DC (+.7%), Chicago (+.5%) and Boston (+.3%) still gained month-over-month. Year-over-year, prices are down 17%.

The table below shows the month when each market peaked, the size of the drop from the market’s peak, the change since May 2008, and the change since April 2009. We also show the month in the past when prices were last at this level (“equivalent month”):

| Area | Date of Peak | Drop from Peak | YoY Change | MoM Change | Equivalent Month |

|---|---|---|---|---|---|

| Los Angeles Real Estate | Apr-06 | -41.4% | -19.8% | -0.9% | Jul-03 |

| San Diego Real Estate | Mar-06 | -42.3% | -18.5% | -0.3% | Jul-02 |

| Bay Area Real Estate | Mar-06 | -45.1% | -26.1% | 0.7% | Aug-00 |

| DC Real Estate | Mar-06 | -32.8% | -14.9% | 0.7% | Dec-03 |

| Chicago Real Estate | Mar-07 | -26.4% | -17.5% | 0.5% | Sep-02 |

| Boston Real Estate | Nov-05 | -18.0% | -7.2% | 0.3% | Dec-02 |

| New York City Real Estate | May-06 | -20.9% | -12.2% | -0.1% | Apr-04 |

| Seattle Real Estate | Jul-07 | -22.0% | -16.6% | -0.8% | Apr-05 |

| 20-Metros | May-06 | -32.0% | -17.1% | -0.2% | Apr-03 |

What about the number of sales? Sales of new single-family homes increased 11% in June over May; the strongest increases were again in California and DC; existing home sales were also up month over month, but flat year over year.

The Top-End of the Market Softens

Generally, demand for entry-level homes has been strong this season — the Federal Housing Finance Authority, which calculates price changes based on the conforming loans favored by entry-level buyers, just reported a .9% price increase from April to May, seasonally adjusted. But the top end is starting to move. With jumbo loans scarce, the prices of the big mansions have finally started to drop everywhere except the Bay Area — Redfin has recently seen a sharp increase in million-dollar transactions, especially in Seattle. This change in the mix of home-buyers is one reason median prices jumped by as much as 6.4% in places like Southern California in June — people started buying nicer houses, not just paying more for the same house.

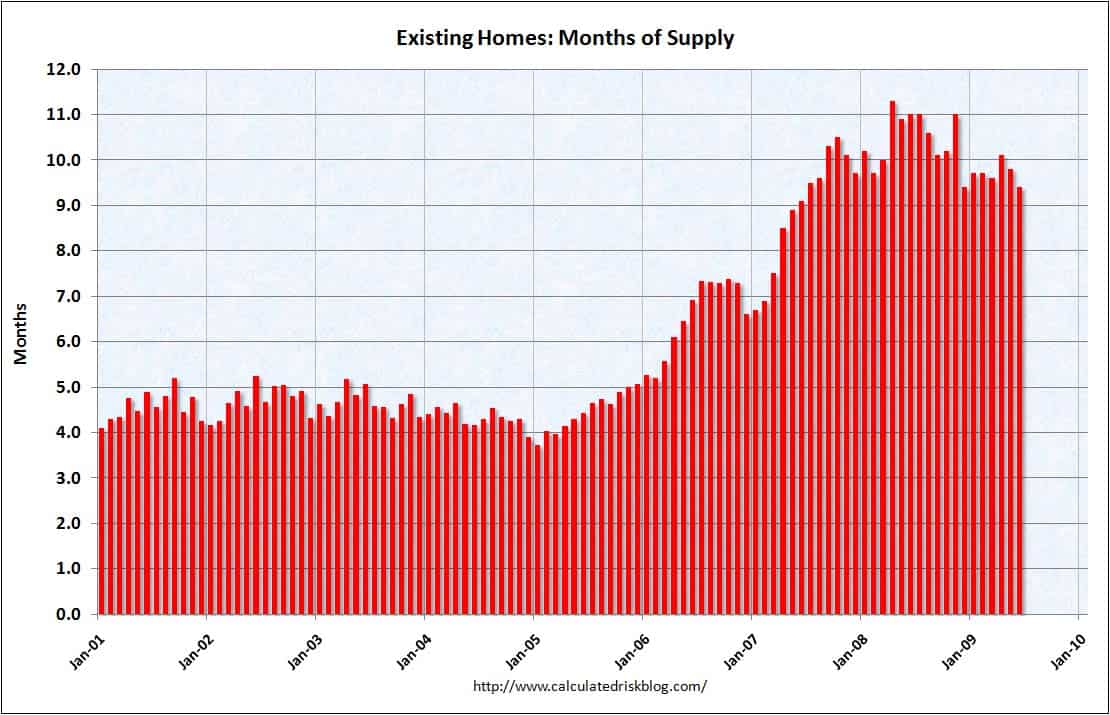

Inventory Declines to 9.4 Months

Inventory has generally decreased, drastically in West Coast markets, where our agents often describe buyers as frantic. In California, we’ve taken clients on tours in late June where a dozen people are lined up to get into the property; sometimes we take three clients through the same houses on the same day. 84% of our Bay Area offers in June involved a bidding war. Nationally, the supply of existing homes for sale fell to 9.4 months; a sellers’ market usually has six months of supply or less. In LA, the number of homes for sale fell by a whopping 54% from May to June.

And the whole market is seeing an increasing percentage of home purchases by investors; in part this reflects sellers’ preference for cash buyers in the wake of new appraisal rules that have gummed up loans but it also may represent the return of smart money.

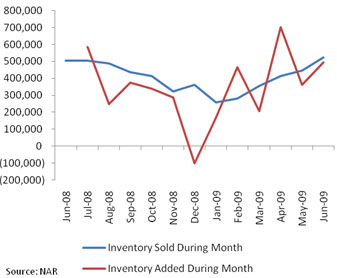

But More Inventory is Coming: 9% Increase in Foreclosure Filings

More inventory is on the way via foreclosures. Nationally, foreclosure filings increased 9% in the first half of 2009 over the previous six months, and nearly 15% over the same period last year. While California mortgage defaults decreased for the first time in a year, many banks are staffing up for more foreclosures by September. What this means is that prices won’t rise with demand: the real estate market is like a grocery-store cereal aisle, where every time someone buys a new box of cereal, the banks put another on the shelf.

There’s also a significant backlog of individual home-owners who want to sell, but know they can’t compete against foreclosures. Here at Redfin, we think prices won’t significantly increase for at least 18 months due to this inventory backlog and continued unemployment; then again, price drops now seem pretty unlikely in most markets.

Mortgage Rates Creeping Up, But Still Very Low

What’s spurring buyers these days are mortgage rates. Rates dropped slightly over the past month, and have over the past year been at historical lows — but they did tick up slightly this week. The national average on a 30-year fixed-rate loan is now at 5.44%. Bankrate’s panel of experts guesses that rates will continue trending up over the next 30 – 45 days. If rates increase a full point to mid-2008 levels, the cost to a home-buyer would be roughly equivalent to a 10% increase in home prices.

Redfin Is Profitable

Meanwhile, life at Redfin is very busy and just super fun too. We notched our first profit this past June, and expect to make more money all summer. When representing home-buyers, our agents are the top-two producers in the Boston area, the top-two in DC, the top-four in Seattle; we’re also at the top of the list in Chicago. And even though we’ve been busy, our customer satisfaction remains at 97%; the company is speaking at next week’s big Inman conference on measuring customer satisfaction and using it as the basis for agent pay.

Our big summer party – the Naked Truth — turned into a mob scene, with 500 people joining a panel of bigshot CEOs, editors and VCs to discuss different ways consumer websites can make money. And we launched a new version of Redfin with better neighborhood stats and free text-search for listings’ marketing remarks – check out Seattle lofts or historic buildings in Washington DC or Chicago homes with a pool. Up next are some super secret Internet gizmos that we’ve been working on for months.

Alrighty, that’s a wrap on another monster newsletter! Any questions? Just write me back; I almost always answer. And thank you, thank you, thank you for all your emails and tweets of support. We live for fanmail.

United States

United States Canada

Canada