Howdy Redfinnians!

For the first time in years lots of pretty houses are coming onto the market, prices posted their seventh small monthly gain, but now demand has suddenly gone missing.

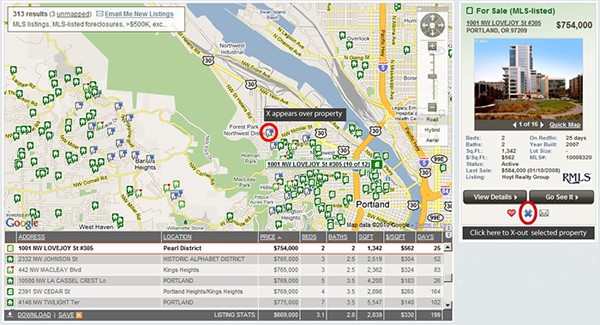

What happened? Let’s dive into the numbers… But first, the Redfin news: on Wednesday, we expanded to cover the Portland real estate market, and added the nifty ability on our website to x-out properties you don’t want to click on again.

Enough about us… onto the data… brace yourself. It’s a mess. Even Wall Street and market research analysts are befuddled.

Buyers Stay In Their Igloos…

The shocker was Wednesday’s Commerce Department announcement that January new-home sales fell 11%, though that was immediately contradicted by more optimistic reports from Wall Street analysts and from the home-builders themselves.

The other shoe fell when the Mortgage Bankers Association announced that last week’s number of loan applications for home purchases dropped to their lowest levels in 13 years. The bankers blame the East Coast blizzard for the one-week blip but most economists remain worried about unemployment. Even in the California real estate market where prices have been rising, sales have been slow.

…But Redfin Demand Has Been Strong

Within Redfin, we don’t know what to make of this bad news. From December to January, visits to our site increased 34%. We set a record Tuesday for the number of homes we put under contract, which is very unusual for February. And it’s not just us: of the offers we submitted to listing agents in January, 54% faced competition, which almost always results in the winner having to pay above the asking price.

Prices Increase Nationwide for Seventh Straight Month

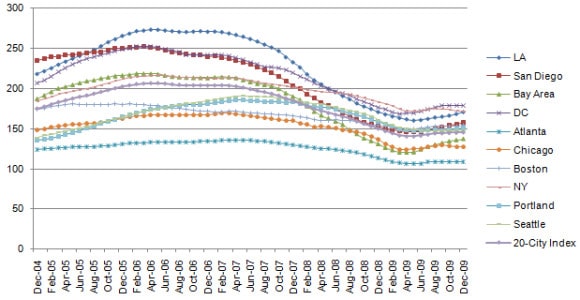

Meanwhile, prices held steady in December. The Case-Shiller data released Tuesday for December 2009 documented a seventh straight month of price increases nationwide, with the strongest gains in California and the Boston real estate area, while the Chicago real estate market and the New York City real estate market declined.

For the year, prices dropped 3.1% nationwide, but actually increased nearly 5% in the Bay Area. The Seattle area was down nearly 8% for the year. As always, we present the seasonally adjusted data, which adjust for summer-time price increases and winter-time declines.

| Location | MoM Change | YoY Change | Date of Max | Change from Max | Prices Last at This Level in… |

Consec. Mos. of Increase |

| LA Real Estate Market | 1.4% | -0.1% | Apr-06 | -37.5% | Nov-03 | 7 |

| San Diego Real Estate Market | 1.1% | 2.7% | Mar-06 | -37.5% | Jan-03 | 7 |

| Bay Real Estate Market | 1.0% | 4.8% | Feb-06 | -37.4% | May-02 | 9 |

| DC Real Estate Market | 0.5% | 1.9% | Mar-06 | -28.9% | Apr-04 | 1 |

| Atlanta Real Estate Market | 0.0% | -3.9% | Apr-07 | -19.7% | May-01 | 0 |

| Chicago Real Estate Market | -0.6% | -7.2% | Feb-07 | -24.8% | Dec-02 | 0 |

| Boston Real Estate Market | 0.9% | 0.5% | Nov-05 | -14.4% | Sep-03 | 2 |

| New York Real Estate Market | -0.5% | -6.3% | May-06 | -20.8% | May-04 | 0 |

| Portland Real Estate Market | 0.5% | -5.4% | May-07 | -19.0% | Jun-05 | 3 |

| Seattle Real Estate Market | 0.2% | -7.9% | May-07 | -22.2% | Apr-05 | 3 |

| 20 City Market | 0.3% | -3.1% | May-06 | -29.3% | Sep-03 | 7 |

Foreclosures Decline, But This is Probably Seasonal

The real estate boogeyman — foreclosures — hid under the bed during the holiday season. In the fourth-quarter, delinquent loans declined 4%, as mortgage bankers predicted “the beginning of the end” of an unprecedented wave of foreclosures. January foreclosure filings declined 10% but RealtyTrac argued that this decline was largely seasonal. If the supply of foreclosures decreases, prices will be much more likely to increase. We still believe there are plenty of foreclosures ahead, albeit mostly in off-coast California, as well as Nevada, Arizona and Florida.

Rates Increase a Bit, But Still Pretty Low (And Likely to Stay That Way)

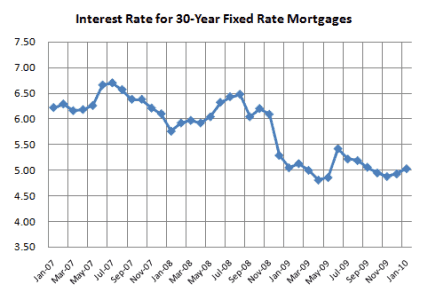

As we predicted in last month’s newsletter, mortgage rates increased slightly this past month, from 4.98% at the end of January to 5.05% this week:

You can see from the graph that rates are still very low by historical standards. And despite worries we’ve had in the past, they’ll likely stay that way for at least a few months, if not all year. As concerns have mounted over the solvency of Greece’s government, the U.S. has been firm about its intention to keep rates low.

The bottom line is that prices have been increasing and money is cheap — and will probably stay that way — but some of the fundamental trends are disturbing: foreclosures dropped but will likely increase again soon, and unemployment is taking its toll on demand.

What will happen next? Tune in next month to find out! As always, if you have any questions — or if there’s other data you’d like to see included in the newsletter — just write back and I’ll try to help as best I can.

Best, Glenn

United States

United States Canada

Canada