Every month, Redfin publishes two newsletters on real estate prices. One, usually published on the last Tuesday of every month, is a Redfin Roundup, which synthesizes data collected by economists, government agencies and others to provide a complete portrait of what happened in the market over the past month. The other is Redfin Insider, usually published by the 12th of each month, which analyzes our own databases to identify the major trends in listing inventory and prices as well as sales activity and consumer traffic. To receive these newsletters by email, just sign up! Here’s the February Roundup:

Big News Redfinnians!

All the big monthly real estate numbers came out over the past 24 hours. December prices fell. January sales volume rose. The number of people borrowing money for March and April purchases increased. The number of properties going into foreclosure is falling.

Our own business went crazy January 1 — mid-February, then things calmed down a bit last week. Buyers have come back from the holidays with more urgency than we’ve seen since last April’s tax credit, but often complain there’s nothing good to buy. Lots of bidding wars in California and DC, fewer elsewhere.

Putting all that together, we think the market’s strengthening. We expect January and February prices to fall, then increases in March and April. We’re not making any long-term predictions because interest rates have finally started rising, with some economists expecting 2011 rates to increase from 5% to 6%.

Prices Drop 2.4% in 2010

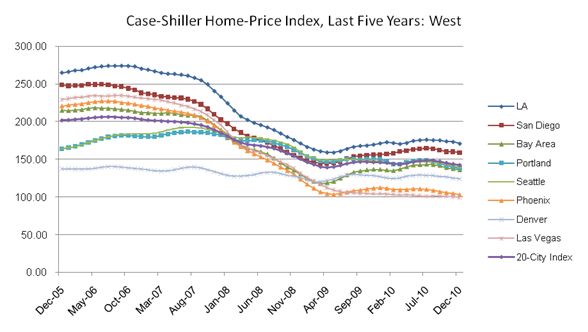

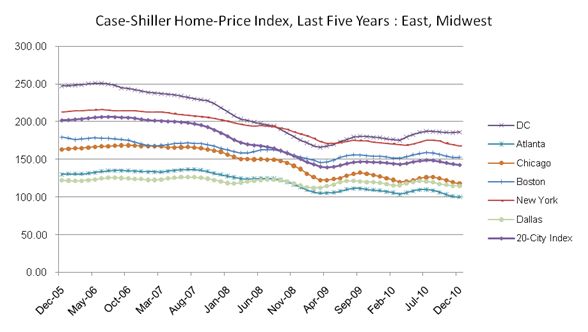

OK, let’s dive into the data! The Case-Shiller index for December home prices showed broad declines across most of the U.S., with prices sinking to levels last seen almost eight years ago, in June 2003:

| Area | MoM Change | YoY Change | Date of Max | Change from Max | Prices Last at This Level in… |

# of Months of Decrease |

| Phoenix Real Estate | -1.7% | -8.3% | Jun-06 | -54.7% | May-00 | 7 |

| Los Angeles Real Estate | -1.3% | -0.2% | Sep-06 | -37.6% | Oct-03 | 5 |

| San Diego Real Estate | -0.7% | 1.7% | Nov-05 | -36.5% | Mar-03 | 1 |

| San Francisco Real Estate | -1.0% | -0.4% | May-06 | -37.8% | Apr-02 | 5 |

| Denver Real Estate | -0.7% | -2.4% | Aug-06 | -11.5% | May-02 | 6 |

| Washington DC Real Estate | 0.3% | 4.1% | May-06 | -25.8% | May-04 | 0 |

| Atlanta Real Estate | -0.9% | -8.0% | Jul-07 | -26.8% | Dec-99 | 5 |

| Chicago Real Estate | -1.4% | -7.4% | Sep-06 | -30.1% | Mar-02 | 4 |

| Boston Real Estate | -0.1% | -0.8% | Sep-05 | -16.4% | May-03 | 5 |

| Las Vegas Real Estate | -1.1% | -4.7% | Aug-06 | -57.6% | Oct-99 | 3 |

| New York City Real Estate | -0.9% | -2.3% | Jun-06 | -22.2% | Mar-04 | 4 |

| Portland Real Estate | -1.2% | -7.8% | Jul-07 | -25.9% | Feb-05 | 6 |

| Dallas Real Estate | -0.2% | -3.6% | Jun-07 | -9.4% | May-03 | 6 |

| Seattle Real Estate | -2.0% | -6.0% | Jul-07 | -27.9% | Dec-04 | 5 |

| 20 City Index | -1.0% | -2.4% | Jul-06 | -31.0% | Jun-03 | 5 |

A Rocky Bottom or Another 25% to Fall?

The two economists behind the Case-Shiller index differed in their outlook for what’s ahead, with Karl Case arguing the market was at a “rocky bottom with a down trend,” while Robert Shiller saw “a substantial risk” of 15% – 25% declines.

In the West, only San Diego saw year-over-year price increases:

In the East, only Washington DC saw year-over-year and month-over-month price increases:

Why Has Redfin Been So Bullish?

We’re one of the only ones who are more optimistic. We recently wrote in the Wall Street Journal that housing numbers through February would be “woeful,” but that we expected the double-dip to stop dipping in March.

Do we still feel that way? Mostly. Demand was stronger two weeks ago when we wrote that article, but it’s still pretty strong now. New Redfin customers increased only a modest 6% from one four-week period to the next. Over that same span Redfin customers signing offers has increased an eye-popping 54%.

Nationwide, existing-home sales in January increased 5.3% compared to January last year. Over the past four weeks, mortgage applications for home purchases increased 1.6% — and that’s after adjusting for the seasonal rise in activity we expect this time of year.

While demand is rising, the supply of distressed homes is falling. Mortgage delinquency rates fell 11% in the last three months of 2010, mostly because banks have become more aggressive about modifying loans or approving short sales to avoid a foreclosure. Year over year, foreclosure filings have decreased 17%.

The question is, will the market recover before interest rates rise? Rates hit 5.05% last week before sinking down to 5%:

The Wall Street Journal reports that rates may reach 6% by year-end. Oh and did we mention all the other bad stuff that could happen? Mideast turmoil, the possibility of a government shutdown, a six-month jail term for Lindsay Lohan? Pandemonium.

But we think everything’s going to be ok, and that it will actually get better, at least for a little while, if not for a long while. What’s your take? Leave a comment below and let us know! And thanks as always for your support!

Best, Glenn

United States

United States Canada

Canada