Every month, Redfin publishes two newsletters on real estate prices. One, usually published on the last Tuesday of every month, is a Redfin Roundup, which synthesizes data collected by economists, government agencies and others to provide a complete portrait of what happened in the market over the past month. The other is Redfin Insider, usually published by the 12th of each month, which analyzes our own databases to identify the major trends in listing inventory and prices as well as sales activity and consumer traffic. To receive these newsletters by email, just sign up! Here’s the May Roundup:

Howdy Redfinnians!

Time for the latest round-up on real estate prices! But first, we want all of you to drop everything and upload your gorgeous photo to your new Redfin profile, so we can welcome you back to our site in style.

We Were Wrong

Now to the numbers! Let’s get this out of the way right off the bat: we were wrong. In February, we wrote that we expected prices to start bucking up in March and April. The March Case-Shiller numbers out Tuesday showed a .8% drop nationwide. But then we were right: a day later the numbers used by the Federal Reserve came out for April showing a .7% increase. Crazy, right? As we wrote last month, after nine months of falling prices, the next six will probably be up and down.

Few Buyers, But Few Sellers Too

It’s a bumpy ride because supply and demand are racing to the bottom. Our website added a million users in the first three months of 2011, then went flat, as buyers began to pull back. But new listings are falling too: bank-owned listings declined 6% this spring, and the regular stuff declined by 14%. Would you sell right now if you didn’t have to? If a pretty house does hit the market in one of the big cities, there’s usually a bidding war.

And when sellers won’t sell and buyers can’t buy, summer sales volume goes down the drain. From March to April, closed transactions declined .8%, and pending sales fell 11.6%. That’s the bad economic news. The good news is that even if prices are up and down, they aren’t going to drop another 9% from May – December, as some have claimed. We think the second dip isn’t going to be like the first one.

And No, We’re Not Lying Scuzballs

But before making our case, let’s remind everyone we’re not lying scuzballs.

When prices were still rising, Redfin went on national TV last June to say that the market would become like a fat man who couldn’t get up. In September, we emailed all of our customers in Seattle to say prices would decline another 10%. Many of our customers changed their minds about buying a home back then; it cost us a lot of money but we’re glad they did. So as John Kerry would say, we were for the double dip before we were against it.

How Do We Get Off the Bandwagon?

Now that the band-wagon is rolling downhill fast, we want off of it. The New York Times front page published a glum report on the Case-Shiller index likening the slump to the Great Depression, the day before the numbers came out. A day later, same newspaper, same reporter, but the headline was now: Bottom May Be Near For Housing Slide.

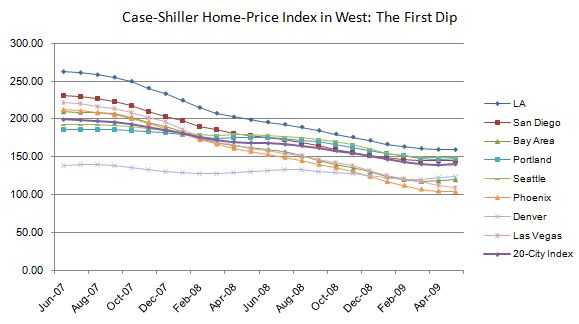

If you’re getting that here-we-go-again feeling, maybe it’s because you’ve just forgotten how sickening that feeling once was. In the West, check out how steep the drop was from 2007 – 2009:

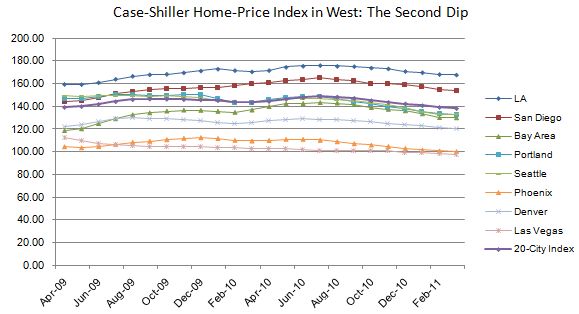

Now focus on the last two years:

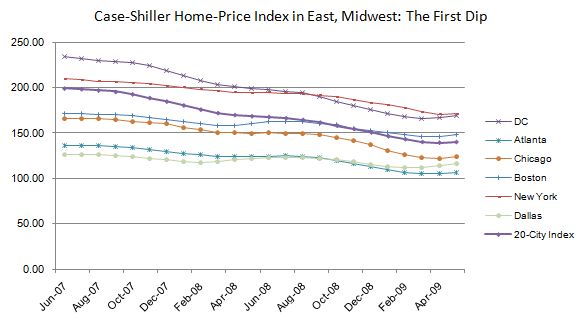

It’s the same story in the East and Midwest. The first dip was a doozy:

The second, not so much, at least not yet:

Now past performance doesn’t predict future results but does this look like the middle of a roller-coaster ride, or the end? Bubbles last longer than you’d think, and so do declines, because of the market’s emotions, what Robert Shiller calls “animal spirits.” So figuring out when greed trumps fear is never an exact science.

The Banks: Bleeding Out Inventory, Not Gushing

However much the market wallows in its misery, the truly catastrophic drops were driven the first time around by banks determined to liquidate assets at any price. There’s still plenty of shadow inventory, but new foreclosures hit a 40-month low.

Why? Foreclosures are now taking an average of 400 days to complete, compared to 151 in 2007, mostly because of loan-modification regulations, not the robo-signing scandal. You could build a house, using crude stone tools, in the time it takes a bank to repo one. So most banks are shifting toward short sales, which hold their value a lot better than a foreclosure.

Sure the whole economy is getting scary again and the stock market run ended a month ago; all heck could break loose in employment, government credit and consumer confidence. But when there are reluctant sellers, bidding wars, declining distressed inventory — and mortgage rates just now dropping to 4.55% — we just don’t see what else could drive a steep drop in prices.

Feel free to disagree. We’ve been wrong before and you’ve been right. Just leave a comment below and give us your take.

Have a good June and thanks for your Redfin support!

Best, Glenn

United States

United States Canada

Canada