Every month, Redfin publishes two newsletters on real estate prices. One, usually published on the last Tuesday of every month, is a Redfin Roundup, which synthesizes data collected by economists, government agencies and others to provide a complete portrait of what happened in the market over the past month. The other is Redfin Insider, usually published by the 12th of each month, which analyzes our own databases to identify the major trends in listing inventory and prices as well as sales activity and consumer traffic. To receive these newsletters by email, just sign up! Here’s the August Roundup:

Howdy Redfinnians!

Here’s our August round-up of all the big real estate news! After falling to inflation-adjusted levels last seen in 1999 and 2000, prices are stable again, rising in most markets since April. Nationwide, prices increased 1.1%:

| Market | MoM Change | YoY Change | Date of Peak | Change from Max | # of Months of Increase |

|---|---|---|---|---|---|

| Phoenix Real Estate | 0.3% | -9.3% | Jun-06 | -55.7% | 3 |

| Los Angeles Real Estate | 0.3% | -3.4% | Sep-06 | -38.1% | 3 |

| San Diego Real Estate | 0.2% | -5.3% | Nov-05 | -38.1% | 3 |

| San Francisco Real Estate | 0.4% | -5.4% | May-06 | -38.2% | 3 |

| Denver Real Estate | 1.6% | -2.5% | Aug-06 | -10.2% | 3 |

| Washington DC Area Real Estate | 2.3% | -1.2% | May-06 | -26.9% | 3 |

| Atlanta Real Estate | 1.5% | -4.9% | Jul-07 | -23.6% | 3 |

| Chicago Real Estate | 3.2% | -7.4% | Sep-06 | -31.4% | 2 |

| Boston Real Estate | 2.4% | -2.1% | Sep-05 | -15.3% | 2 |

| Las Vegas Real Estate | 0.1% | -6.0% | Aug-06 | -59.3% | 1 |

| New York City Real Estate | 0.9% | -3.6% | Jun-06 | -22.8% | 3 |

| Portland Real Estate | 0.0% | -9.6% | Jul-07 | -27.9% | 3 |

| Dallas Real Estate | 1.4% | -4.3% | Jun-07 | -8.4% | 3 |

| Seattle Real Estate | 0.7% | -6.4% | Jul-07 | -28.5% | 4 |

| 20 City Index | 1.1% | -4.5% | Jul-06 | -31.6% | 3 |

Case-Shiller Price Index Data for June 2011

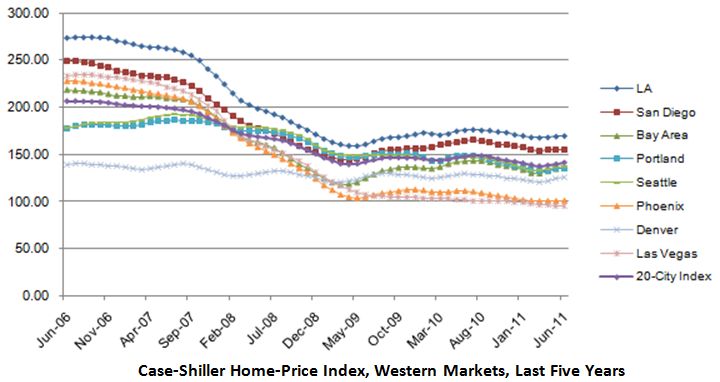

Even adjusting for the summer surge, prices were still flat. So this is exactly the bottom in pricing that in February we predicted would begin in April, and it is fairly uniform across the West:

Case-Shiller Home-Price Index, Western Markets, Last Five Years

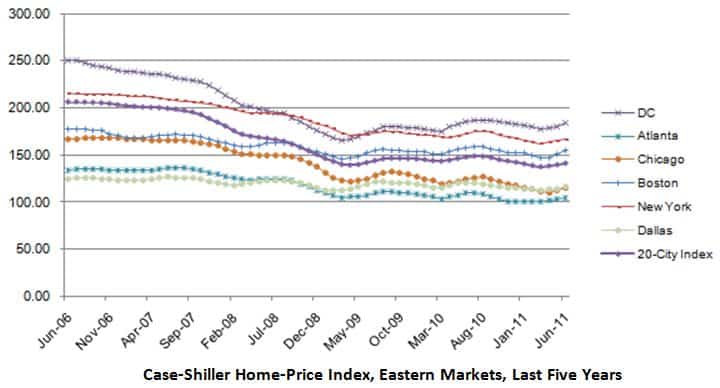

Prices have been less volatile in the East and the Midwest, and DC continues to be America’s strongest market:

Case-Shiller Home-Price Index, Eastern Markets, Last Five Years

A Cold Winter Ahead for Home-Buyers

Now the question is, with all the economic uncertainty in the Mad-Max aftermath of the debt crisis, will it last? Once the stock market lost a trillion dollars on August 5, we reported that the number of customers making offers that weekend actually increased. Strong demand held up another week, but then slipped last week by 18%.

About half of this is seasonal — the last bit of August is always slow because of vacations and the back-to-school rush — and the rest we think is genuinely due to economic uncertainty. We don’t think of this as a calamitous drop, and it’s hard to take one week as a trend, but it’s bad news.

But The Reason Prices Are Steady is Because of Limited Supply

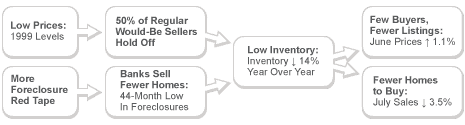

The truth is that demand has been weak since the tax credit expired in the summer of 2010. The reason prices have stabilized is because of supply: there aren’t many buyers out there, but there are even fewer sellers.

Nationwide, the number of homes for sale has declined 14.1% since last summer. Our buyers constantly complain about the lack of inventory, and many just give up in frustration. A good deal is hard to find.

The first sellers to pull out of the market were the ones who drove prices this far down in the first place: the banks. More people are falling behind on their mortgages, but foreclosure activity just hit a 44-month low.

The drop in foreclosures is partially because the government made it harder for banks to take people’s houses, and the rest is because the banks decided they couldn’t sell those houses for much anyway.

Shadow Inventory Is Probably Smaller Than Most People Think

So now we see the banks sending delinquent homeowners one notice of default after another without ever actually foreclosing. This tells us that the shadow inventory that has taken on titanic proportions in the popular imagination is smaller than most pundits claim. And the regular human beings we talk to about listing their home for sale are often now deciding to wait a year for better prices too.

We don’t see the market getting swamped with new inventory while prices are low, but we do think that all the would-be sellers will jump into the game once demand strengthens, preventing prices from rising much either. This is why we think prices will stay low for a long time, but not drop significantly further. We’re on the bottom and that’s where we’ll stay.

Low Sales Volume is Mostly the Result of Low Inventory

When inventory is this low, sales are low too, down 3.5% in July, and down even more among foreclosures. The press often reports falling sales and rising prices as a conundrum but both are the result of there being very little to buy.

That’s it for August! If you have any comments or questions about a particular area, leave a comment below and we’ll hook you up with the best Redfin real estate agent to pitch in with more local insights. We won’t bother you later, either. It’s our job, so ask away. Have a great August, and thanks for your support!

United States

United States Canada

Canada