Big news Redfinnians!

Redfin just raised $15 million, mostly on the strength of nice revenue growth and very, very happy customers. Since launching our service with one Seattle real estate agent in 2006, we’ve closed about $6 billion in home sales, with a customer satisfaction rate of 97%. Consumers have saved $85 million in commissions. The value of the company has increased a hundred-fold. Woo-hoo!

That’s the view from on-high but Redfin is also taking it to the streets, running new neighborhood-level meet-ups with appraisers and inspectors to teach you how to assess what a home is really worth, and where to look for hidden problems in its construction. Redfin agents run the show at these events, so it’s an easy, no-pressure way to meet those folks too.

Take Cheap Money. Add Frantic Banks. Stir…

But enough about us. What’s new in the real estate world? A lot of weird stuff. We’re seeing second mortgages coming back for the first time in five years. We’re seeing homes prices drop so low — to $40,000 or $50,000 — that agents and lenders don’t want to work on ’em.

We see non-recourse states like California — where borrowers can walk away from their house without being sued — working through distressed inventory faster, which tells us they’ll bottom out sooner. In places like Vegas and Phoenix, we see short sales getting approved in seven days, not seven months.

The Leaves Began to Fall. Demand Didn’t

In our own business, customers writing offers picked up sharply in mid-October, right after rates dropped below 4%. This was the first time in years we saw buyers respond to lower interest rates.

Then last week, our business slid back a bit, and will probably keep moving south for the rest of the year. November’s always risky because of the holidays but there was enough activity in October that we’ll probably see a lot of Thanksgiving closings.

Across the U.S., sales volume dropped 3% in September, but was up 11% from last year, when the market was sleeping off a tax-credit hangover. Investors accounted for fewer sales because they couldn’t find as many deals. Foreclosures have been down for a year, and still the Shadow Whisperers insist that a big wave of distressed inventory is about to wreck the market again.

Worried About Shadow Inventory? Turn on the Lights

I used to be one of those people but here’s what changed: we worried about 2006 mortgages with expiring teaser rates, only to learn that the new rates are lower than the teaser. We worried about banks flooding the markets with foreclosures after the robo-signing scandal, but their real strategy seems to be trickling it out, just so they don’t drown themselves.

This means that distressed inventory’s impact isn’t so much to lower prices as to prevent them from rising for many, many years. Whenever a seller tries to get more money, the bank will foreclose on a home down the street, undercutting his efforts. I believe the banks will be doing this not just in 2012 but in 2013, 2014.

And Home Prices Are Flat or Down or Up

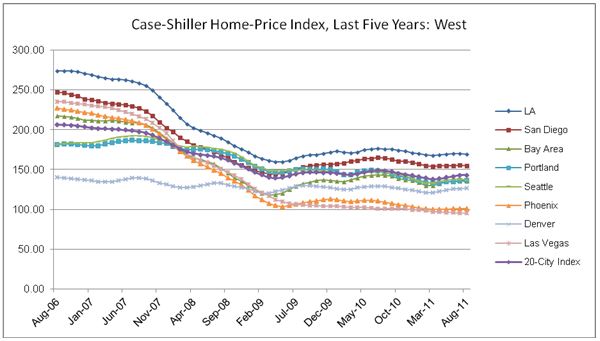

The latest indexes reflect this reality. For the fifth straight month, home prices are flat: up .2% in absolute terms but really flat once you account for summer-time surges. Prices dropped 4% last winter because the government stimulus expired but nothing much has moved prices since:

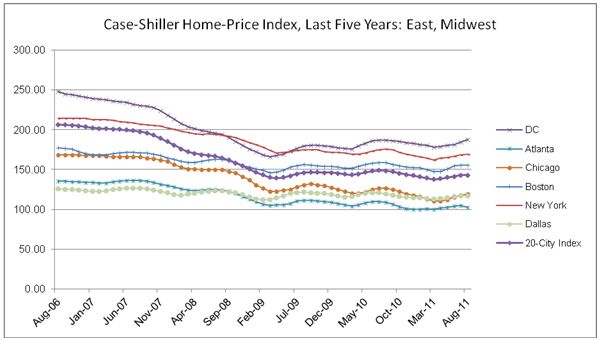

The East and Midwest have been even more stable:

Adjusting for inflation, prices are at 1999 and 2000 levels and the ratio of home prices to rents are at 2000 levels too. The fact that rents are stable or rising in most cities has begun to put a floor on how far entry-level home prices can fall, barring complete economic Armageddon.

The New Normal Is Just Normal

And as the President of the Federal Reserve Bank of New York noted on Tuesday, America doesn’t really need prices to rise; would-be home-buyers just have to believe that prices have stopped dropping to get on with moving up or moving out.

For consumers this is all a bit like Scream 4: at some point you get tired of being scared and then you’re just bored.

And when you’re bored you can make rational decisions. If you need to move you will, without feeling like a sucker. If you want to flip a home for twice its value, you’ll just lose money. There won’t be another panic anytime soon and there won’t be another frenzy either. That’s a good thing.

Thanks for your support!

Best, Glenn

United States

United States Canada

Canada