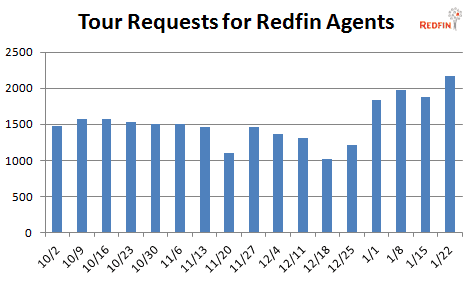

The first month of every year for Redfin is like the first five minutes of a blind date: it doesn’t take long to figure out how the whole thing will go. We track every customer activity in a big database so it’s easy for us to see whether demand is strong right out of the gate.

And it is. While January and February closings will likely be weak, recent charts of early-stage Redfin demand suggest that in a few months sales volume will be just fine. From January to December, visits to our website increased 35%. Customers touring homes increased 26%. Customers writing offers increased 35%.

We aren’t in a tizzy about such growth, because most of it is seasonal. We get big jumps like this every year.

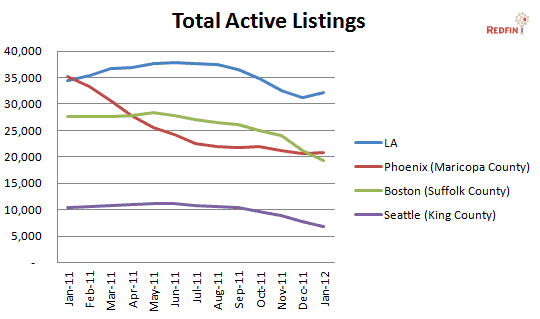

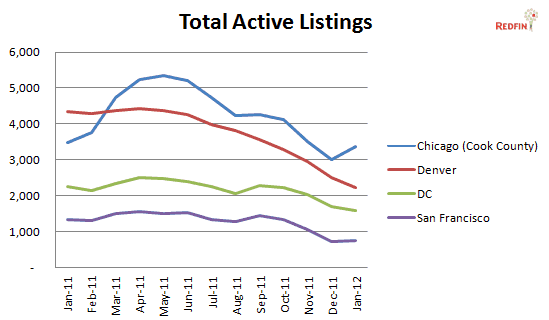

But we are seeing one trend this season that isn’t normal. And it could really crimp sales volume and, by extension, the whole economy. Inventory, which normally starts climbing steeply in January, has just kept dropping. In our wildly popular home-buying classes, which are mostly sold out, the most common complaint is that there’s nothing good to buy.

In some of the biggest counties, there were 30% – 40% fewer homes for sale this January compared to last January, and most counties saw the problem only get worse in the past month:

And the same is true of smaller counties, too; only Chicago has seen an uptick:

We see why this is happening in listing consultations across the country. We sit in people’s living rooms, explaining what they can likely sell their home for, and they just decide to wait a year instead, either because they want more money for their home, or they flat-out need more money just to pay off the mortgage.

The banks have an enormous number of mortgages in default, but, after the robo-signing scandal, foreclosures have been at or near three-year lows because it takes nearly a year to foreclose a property. In Atlanta last year, there was a 13-month supply of bank-owned homes; now there’s a two-month supply.

As a result, the limit on sales volume, which has long been demand, is increasingly now supply. American real estate is, in some places, like a giant store, the shelves half-full, often with damaged goods. Fixing this problem will be hard because it requires a fundamental re-structuring of debt, whereas stimulating demand is often a simple matter of lowering interest rates.

What this means for the individual home-seller is that Tim Ellis was right. Tim, Redfin’s real estate analyst, prepared a comprehensive analysis showing that homes listed in winter sell for more money, faster, with less risk, than homes listed in summer. The findings were so surprising that I delayed their publication for nearly a month, insisting that Tim look at possible confounding factors. After I ran out of reasons to block the report, we published it, but I still didn’t believe it.

But anyone who listened to Tim, and hung a sign in their yard this winter, is probably glad she did. Good listings have very little competition just now in most markets, and plenty of demand. Just this weekend, we sold a Portland home in 48 hours, with four offers coming in all over asking price.

This may change, as many sellers who took their homes off the market before Thanksgiving will be back on the market in February or March, after waiting the requisite 90 days for brokers to market the property as new again. But in many places now, we see a lot of demand, and not much to buy. It would be interesting to hear from real estate consumers and agents alike if your experience has been different or the same.

United States

United States Canada

Canada