We’ve written about feisty buyers, shown data on multiple offers and told the story of Mid-Peninsula Madness. That opened up the floodgates, and now we’re hearing from our agents across the country: Buyers are frustrated with the lack of homes on the market, and the few sellers out there are using scarcity to their advantage.

Sellers Have Swagger

Home sellers are in the driver’s seat, and they know it.

- Triple backup offers: In Washington DC, Redfin agent Nick Chaconas saw the desperation from the side of the listing agent. “The house I was selling went on the market at 1 p.m. on Friday, Feb. 10 and I had an offer in hand by 8:30 a.m. the next day,” he said. “I didn’t even have time to send the offer to the seller before another agent told me her client was writing an offer too. The home was under contract by Monday, the 13th when a third agent called, wanting to write a back-up offer. Even when the first offer fell through, the second offer was more than happy to step in, and the third offer still wanted to hang around as the backup.”

- Family photos and personal letters: In the Seattle area, January saw 7.7% fewer homes for sale than December, and 35.1% fewer since the previous January. Seattle Redfin agent Lori Bakken had a client who was ready to put an offer down on a home, but then came a type of request she hadn’t seen for a long time. “The listing agent said the sellers were asking for letters or photos of any of the families making an offer, to help them make a decision. We submitted the letter and photo, and offered $10,000 over list price, but lost to a higher bidder. You won’t see that in a buyer’s market.”

- Appraisals ignored: In San Diego, Redfin Area Manager Anna Nevares says sellers are even asking buyers to commit to a purchase before the appraisal, regardless of the outcome of the appraisal. “Sellers know that buyers are desperate enough to waive the typical appraisal contingency. If it appraises low, the buyers will cover the difference by bumping up the down payment. They won’t let an appraisal get between them and the home they want.”

- Unlisted sales: Redfin agent Collin Horn was contacted by a seller who knew it was a seller’s market and wanted to represent himself, hoping to save on commissions. “He saw the Agent Insights I’d left on homes similar to his, in the same neighborhood, and rightly assumed that I’d been touring with an eager buyer recently,” Horn said. “My client ended up buying his place. The seller knew buyers were getting frustrated with what little was on the market and he used it to his advantage this time.”

Desperate Times Mean Desperate Measures for Buyers

There are some old tactics that are getting dusted off and some new ones that agents are adding.

- Mass emailing for homes: In Denver, agents are blasting emails to agent listservs asking if anyone has any pocket listings (homes that are for sale, but not listed on the MLS). “I haven’t seen this type of request in five years,” said Michelle Ackerman, Redfin Market Manager for Denver. “I just started seeing them this year, and I’ve received four so far. It’s strange, but it’s hard to blame them. You have a qualified client with funds, and you want to get them into the right house.”

- Going door to door: Leslie White, a Redfin agent in Washington DC is getting letters from other agents asking if she wants to sell her own home in Mount Pleasant, a neighborhood that has seen a 32% drop in supply since last January. “At the low end of the price scale in established neighborhoods, investors looking to flip houses are swooping in, buying everything, renovating and listing for a huge profit. Sometimes they don’t even wait for properties to go on the market, and instead go door to door, leaving door hangers, looking for potential sellers. First-time homebuyers can’t really compete with them.”

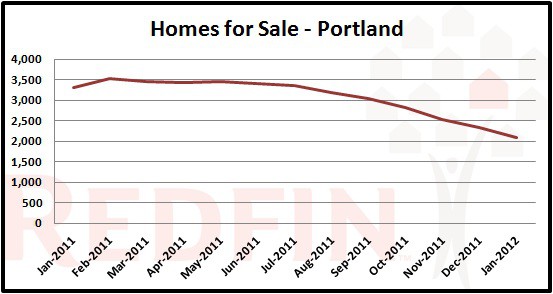

- New construction as an alternative: In Portland, where supply is down 37% year over year, Redfin market manager Jeff Bale sees buyers shifting their focus from resales and signing contracts on new construction homes, many of which aren’t even built yet. “They don’t have faith that the inventory will recover in the 4-6 months it takes to build the home they want.”

- Cash talks…sometimes: And of course, you have the all-cash, no-contingency buyers that every seller hopes to find. But as we wrote about in a post on “Mid-Peninsula Madness” in the Bay Area, even that’s not a sure thing anymore when we see all-cash, no-contingency buyers in bidding wars with other all-cash, no-contingency buyers.

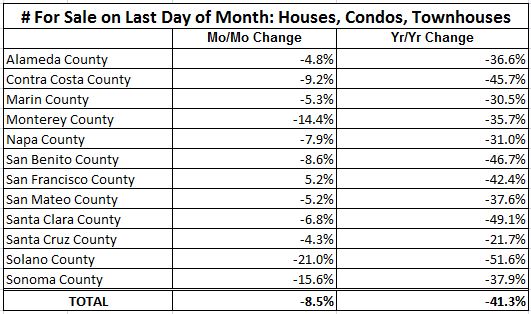

The Numbers

The data highlight the scope and scale of what our agents are seeing every day. The number of homes for sale has dropped by double digits in most counties, cities and neighborhoods, and they’re still declining. Just take a look at the Bay Area in January 2012. The column on the right says it all.

Nationally, in the markets where Redfin has offices, it was more of the same. Each had varying degrees of year-over-year declines in the number of homes for sale in January:

- Denver (Denver County): -47%

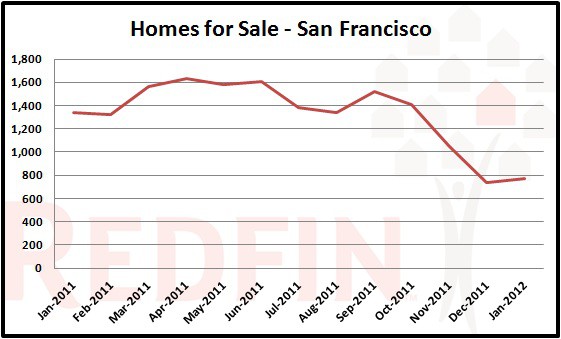

- San Francisco (San Francisco County): -42%

- Phoenix (Maricopa County): -40%

- San Diego (San Diego County): -38%

- Portland (Multnomah County): -37%

- Seattle (King County): -32%

- Orange County: -32%

- Washington DC: -28%

- Los Angeles (Los Angeles County): -27%

- Dallas (Dallas County): -27%

- Las Vegas (Clark County): -16%

- Atlanta (Fulton County): -13%

- New York (Queens County): -8%

- Chicago (Cook County): -7%

- Boston (Suffolk County): -1%

Where Have All The Sellers Gone?

In a recent survey of home buyers, 56% said now is a good time to buy, whereas only 13% said now is a good time to sell. Why the difference? The buyers said they think stagnant prices are keeping people from listing their homes. “Unrealistic home sellers who expect 2007 prices,” one buyer called them. Regardless, home owners know what they paid, they know what they can get in the current market and decide instead to make their mortgage payments and bide their time while they wait for prices to recover. The good news for those folks is that we think the bleeding will stop this year and we’ll start down the slow path to recovery.

Context for the Shortage

Not all inventory crises are created equal, and like everything else in real estate, location is the key to how hard the inventory crisis is being felt. The number of listings in any given market is just a number, without context. A thousand homes on the market in Multnomah County, Ore. goes a lot further than 1,000 homes on the market in Los Angeles County.

The map and data below show the areas with the lowest inventory per household, so you can see which areas feel the shortage the most. For example, in San Francisco, there’s only one home on the market for every 470 households. While that can partially be explained by its strength as a rental market, the level of demand also puts it at the center of the supply shortage. California in general is particularly hard hit, with the Washington DC area not far behind.

Float over any county on the map or its colored bar on the table for more details about inventory in that city.

Are you one of the frustrated buyers, sitting on the sidelines with stellar credit, not seeing the right house come on the market? Share your stories in the comments!

United States

United States Canada

Canada