Here is Redfin’s monthly email newsletter, with a little about Redfin and a lot about what’s happening in the real estate market.

Howdy Redfinnians!

Ready for another roller-coaster ride through the U.S. real estate market? Home prices have for the moment been defying gravity, rising while the global economy sags. When will the other shoe drop? Not ’til September at least. By yesterday Redfin had booked as much 2012 revenue as we got all year in 2011. And weirdly for this late in the summer, new customers keep showing up at our door in greater numbers.

Redfin’s Listing Business Set to Double This Year

Some of Redfin’s growth is because of our own listing business: 41% of our June listings were under contract in less than 14 days. Every home our agents list gets promoted across our site — now for the first time the #1 brokerage site across the 19 markets we serve — and on our top-rated mobile apps. As a result, our listings get double the traffic on Redfin.com, and we’ve been selling ’em 15 days faster and for more money than the industry average.

When Will the Other Shoe Drop?

But the U.S. economy is having another lions-tigers-and-bears moment, with jobs and consumer confidence in the tank, even as Goldman Sachs finally made its bottom call for real estate, five months late. In an interview last week, Warren Buffett said real estate had been holding the U.S. economy back for years, but now the situation is reversed.

June Prices Up 3%

Redfin’s data for 19 U.S. markets show June prices increasing 3.0% over last year, with one in four homes under contract in less than two weeks; the week before, CoreLogic reported that May home prices increased 2.0% year-over-year, rising for the third consecutive month.

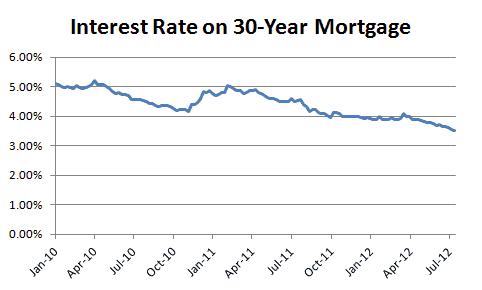

Rates at Record Lows

Low rates and low inventory are creating the price pressure. The interest rate on a 30-year mortgage hit an all-time low last week of 3.56%. This is why cars are selling fast too. The weaker the economy gets, the lower rates go, and the more demand there is for big purchases. Rates below 4% have become like living next door to Michael Jordan: a stupefying fact that we now take for granted.

|

This makes the demand in real estate deep if not broad. The housing recovery has been resilient because people touring homes right now will have good jobs and good credit regardless of macroeconomic swings. Since only half the country can qualify for a loan, the “haves” are the ones buying, often renting the home to the “have-nots.” Rental vacancies are at a ten-year low.

Inventory is the Problem

The number of homes for sale is down 19% from last year, and down nearly 50% in California and Seattle. The builders have been the only ones with plenty of product to sell, buying half-finished lots for pennies on the dollar then quickly finishing the project. June housing starts just hit a four-year high, and builder confidence had its biggest one-month jump in nearly a decade.

Why the inventory crunch? For years, the banks have provided much of the liquidity in the market, selling foreclosures at prices no other sellers would take. But now that the banks are withdrawing, no one else can fill the gap.

Foreclosures Mostly Keep Dropping

Completed foreclosures are down 27% from their 2010 peak, and seriously delinquent mortgages hit a three-year low. Five years into the housing crisis, foreclosures may bounce around a bit, especially in states where the courts get involved, but most of the people who were going to lose their home to a foreclosure already have. In the California real estate market, the Arizona real estate market and the Nevada real estate market, foreclosure sales declined 42% – 72% over the past year.

Sales Dropped in June, Likely to Recover in August

A lack of inventory is the only brake on sales. June sales were off 4.5% from May, and we think July will be weak too. In our own business, demand was weak for most of June, but took off just before the 4th of July and has been strong since. At a time of year when we’re usually closing deals not meeting new customers, just last week the number of new home-buying customers contacting an agent jumped 14% over our four-week average.

The whipsaw changes in demand make for a wild ride. When Redfin’s board asks why our forecasts move around so much, I just try to look like Emilio Estevez and say “That was then, this is now.” And the other shoe is still on my foot. Comments, questions, just leave ’em below!

Best, Glenn

Glenn Kelman | CEO, Redfin

Twitter | Blog

United States

United States Canada

Canada