Here is Redfin’s monthly email newsletter, with a little about Redfin and a lot about what’s happening in the real estate market.

Howdy Redfinnians!

Welcome to another action-packed newsletter filled with facts, figures and bold predictions about the U.S. real estate market!

First, the Facts

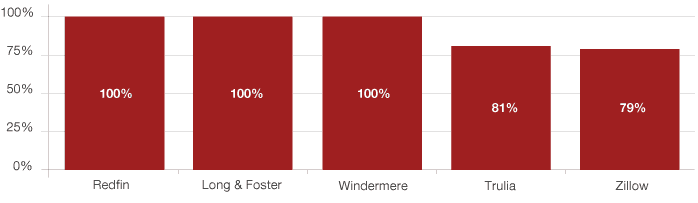

First, the blatantly self-serving but absolutely true facts. Redfin commissioned a study comparing thousands of listings on local brokerage sites like Redfin.com to national portals like Zillow and Trulia. The study found that Redfin has 20% more agent-listed homes for sale, and gets new listings 7 – 9 days faster; nearly 2 out of 5 homes that appear on the national portals as active listings actually have already sold. To see for yourself, just compare search results for your neighborhood.

|

Percent of Agent-Listed Homes Appearing on Different Websites

Moving Up from the Bottom

That’s the Redfin news, but what’s going on in the U.S. housing market? You may remember back in February, Redfin was one of the first to call the bottom of the U.S. housing market, even as others were still revising their 2012 forecasts further downward. Who was right?

Well, even the sometimes-bearish Goldman Sachs just predicted that home prices will increase 2.0 percent over the next 12 months, rising another 2.8% in the following 12 months. JPMorgan CEO Jamie Dimon said on Friday that housing has turned the corner.

Only 11% of consumers now expect home prices to decline. U.S. home prices jumped 5.4% in September over last year. Over that same time, inventory declined 29%.

The Number of Homes for Sale in 2012 Is Way, Way Down |

Many Buyers, Few Sellers

And from here on out, the inventory crunch will only get worse. With less than eight weeks before Thanksgiving, few sellers will jump into the market now, so supply will keep falling.

But demand so far has shown little sign of slacking off; in September, when back-to-school usually slows buyers, 3.5% more Redfin home-buyers toured U.S. homes for sale and 4.5% more wrote offers to buy them. Mortgage applications for home purchases hit the highest level since June, though we expect that to slow starting this week.

Shadow Inventory, Shadow Demand

The market just now feels like the last day of summer camp, when everyone tries to hook up; most campers spend the drive home staring out the window of Mom’s station wagon. Home-buyers are headed into the holidays feeling the same frustration.

The result is a relatively new phenomenon. Just as economists have long worried about shadow inventory — the reserve of foreclosures banks haven’t yet put on the market — we now see shadow demand, with hundreds of thousands of would-be home-buyers from 2012 going into 2013 still looking for a place.

The Conspiracy Theories and the Truth

But hold up, you say, what about that shadow inventory? For months now, we’ve been duking it out with suspicious readers about whether the banks have been conspiring with one another to dump more foreclosures on the market once prices rise. But every month it has become more clear that the conspiracies are canards.

True, foreclosures are continuing to rise in the judicial-foreclosure states, where a court runs the foreclosure process. It turns out that foreclosures can be fair or fast, but not both. The states that are fast, like Arizona, mostly shrugged when a resident lost his home in a rigged foreclosure, but now Arizona will recover three years ahead of the states that were fair, like Florida. Nationwide, foreclosures hit a five-year low.

The Rise of Short Sales

Short sales, where the bank lets a home-owner sell the place for less than he owes on the mortgage, have been the safety valve. As we predicted more than a year ago, in the most distressed parts of the country there are now three times more short sales than foreclosures. These sales are far better for local real estate prices than a foreclosure, mostly because the home hasn’t been left for dead over 18 months.

It’s making a big difference: shadow inventory has declined over the past year more than 10 percent. For underwater home-owners who want to stay where they are but just need a lower rate, government programs are finally helping too, as people are now paying off their old mortgages at a rate not seen since 2005.

Interest Rates Keep Falling

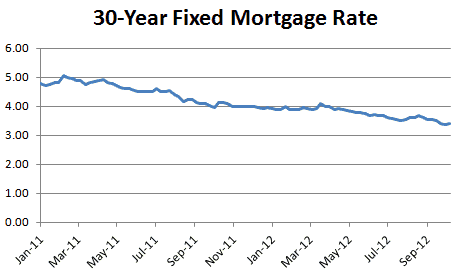

And interest rates keep falling. One area where we were dead wrong, partly out of some misguided political conviction, was about how long the government could keep rates down. As economists like Paul Krugman never tire of noticing, it turns out the government can keep rates low for a long, long time:

Interest Rates Are At Historical Lows |

Our Bold Prediction: The Empire Strikes Back

So if real estate is doing so great, when will it help the rest of the economy? U.S. banks have already benefited, with the two biggest just reporting record profits. Finally, inventory has started to increase in at least one market, Phoenix, as higher prices induce owners to put their homes on the market, which will in turn increase sales volume.

We think this trend will broaden in 2013. Next year will be the first year in the last seven to begin with a wide consensus that home prices are rising. Given the backlog of people who have wanted to move for years but couldn’t, we think there will be a flood of new listings after the SuperBowl, which will create far more sales and far more jobs in the real estate industry. Already, Redfin is hiring like mad.

Construction will pick up too. The Federal Reserve just reported not just strengthening home sales but more construction across most of the country. Jobless claims declined sharply last week; consumer confidence still isn’t strong, but posted a five-year high. Political commentators have wondered whether the much-improved unemployment numbers are a statistical fluke or a political conspiracy, but there is a third possible rationale: it’s real estate, stupid.

Real estate will never grow to the proportions it had at the height of the Bush-era bubble, when it was two and a half times larger than it is today. But it is why things will get better. In fact, it’s why they already have. Life is full of ups and downs, but after four years of bad news from the real estate industry, a few ups are ahead.

Questions, comments, quibbles? Just fire away in the comments section below! Thanks as always for your Redfin support.

Best, Glenn

Glenn Kelman | CEO, Redfin

Twitter | Blog

United States

United States Canada

Canada