Today Redfin launched the Home Value Tool, a new online feature that helps homeowners estimate the value of their home. The tool is the vastly improved version of the home price estimator we introduced in March of last year, which helped grow the listing business by 120% in 2012. The Home Value Tool looks better, flows better, and uses the most up-to-the-minute real estate data out there. It’s the best way to price your home online because it prices your home the way an agent would.

We started working on the Home Value Tool when we realized that in real estate, there’s no magic formula or complicated algorithm listing agents use to figure out how much your home is worth. Instead, they create a list of every home in your neighborhood that sold in the last several months, grab a big red marker, and emphatically start crossing homes out until they’ve got a list of the four or five that are most like yours. Then they make some small adjustments, take an average, and give you a price.

Agents work this way because they know more about the homes in your neighborhood than just their square footage or number of beds and bathrooms. They’ve seen these homes inside and out, so they can say that a recently sold ranch-style house with a view of the river is similar to yours and that the house down the street, which looks just like yours on the outside but has an outdated 1960’s interior, isn’t. Their local knowledge gives them the edge over any algorithm for pricing a home.

Agents aren’t the only ones with a local edge. Homeowners have one too. Probably not as much as agents do, but certainly way more than a number crunching computer hundreds of miles away. That’s why we made the Home Value Tool more than a black box that spits out a number. We built it to take advantage of what homeowners know about where they live. Here’s how it works.

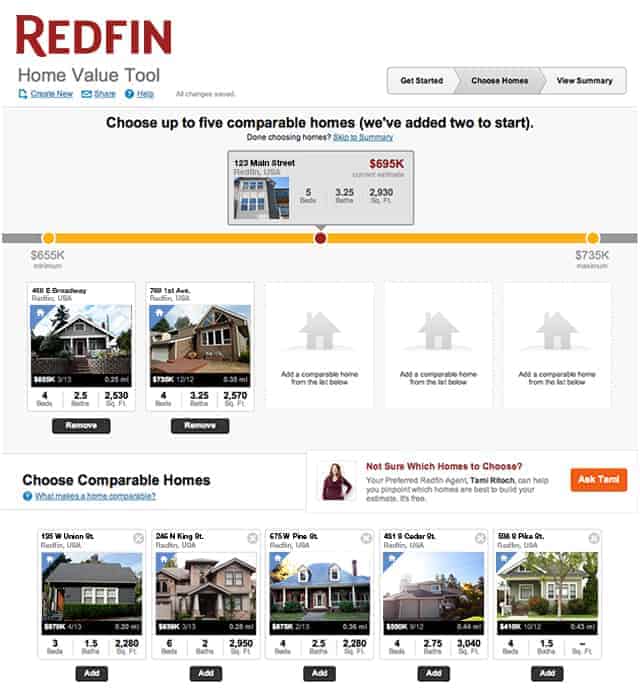

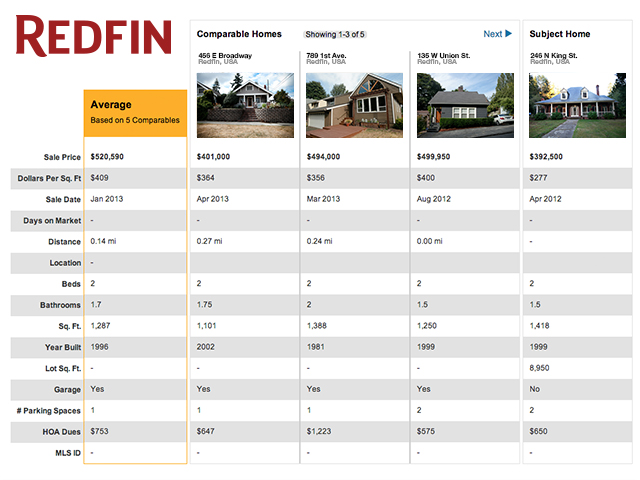

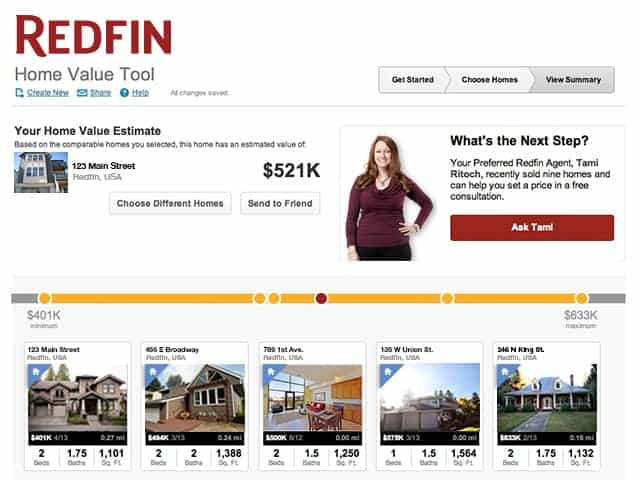

The Home Value Tool takes your address and shows you a list of homes recently sold in your neighborhood based on the most up-to-date real estate data available. Then you look through those homes and choose the three most like your own based on what you know about your neighborhood and stats like square footage and the number of beds and baths. When you’re done, we show you an estimate of your home’s value, a map of all the homes used to create the estimate, and a chart that lets you compare them all to each other.

And if you want a real estate agent’s opinion of your estimate, we’ve included a button to contact a Redfin Agent in your area.

Click here to take Redfin’s new Home Value Tool for a spin. Or if you’re feeling a little like some fun, use it to price Carmelo Anthony’s mini-Versailles, Kim and Kanye’s iberian palace, or Channing Tatum’s tropical bungalow.

United States

United States Canada

Canada