David Pollack, a real estate agent at Redfin, experienced this personally. “I bought my house with my girlfriend in October. We will get engaged eventually, but I told her I’d rather spend the money on a house right now. I’ve had three clients who have made the same decision; they want to lock in a good loan now while interest rates are low,” said Pollack.

First of all, we gathered up some wedding statistics:

-

According to The Knot, the average wedding costs $28,427, not including the honeymoon or wedding bands

-

The Knot says wedding bands cost $1,126 for brides and $491 for grooms on average

-

The average newly married couple spends $5,111 on their honeymoon trip, according to a Conde Nast Bridal Infobank survey (cited in BankRate.com)

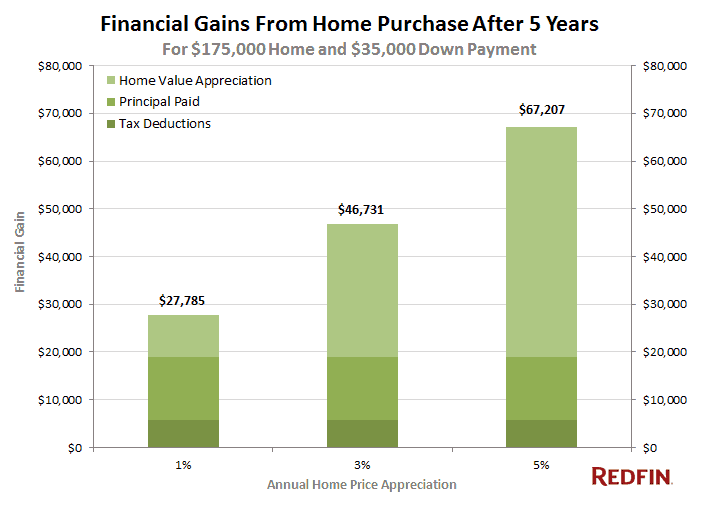

All together, that’s about $35,000. If a couple instead used that $35,000 on a 20% down payment for a $175,000 home, over the course of five years the home would gain nearly $47,000 in equity (assuming an appreciation rate of 3%) – see chart below.

So if a couple spends their savings on a wedding and has to start over from scratch to save for a down payment, they could be losing out on nearly $47,000 over the course of five years.

It’s not just the low mortgage interest rates that are pressuring people to buy now. The stricter mortgage lending regulations have some couples worried about qualifying for a loan while spending money on a wedding. “I have one client – a couple – who put off their marriage so they could buy a home. They’ve been making some plans for a wedding, but can’t put down the reservation fee for their venue until they’ve secured their mortgage, otherwise it could affect their credit score and would prevent them from qualifying for the loan! They’re going to wait to get married until later this year,” said Jordan Clarke, a Redfin agent in San Diego.

Of course not all couples are in the same financial situation; there are some who don’t have to choose between a wedding and a home; the low mortgage interest rates are allowing them to do both. “I’ve seen a few couples who are engaged and planning their wedding while looking for homes. They wouldn’t be able to afford to do both if it wasn’t for the low interest rates right now,” said Sylva Khayalian, a Redfin agent in Pasadena, CA.

Couples who are looking for a home should check out the advice from Redfin agents and relationship expert Andrea Syrtash on what to do to avoid love and real estate conundrums: On Love and Real Estate: 5 Ways To Lose Your Mate

Have you noticed this trend happening with your friends and family? Tell us your story in the comments!

United States

United States Canada

Canada